Aditya Pandav

Founders Office Associate

India’s Electric Vehicle Market: A Look Back at 2023

Introduction

Electric vehicles (EVs) are gaining traction in India, driven by consumer willingness, government initiatives, and market accessibility. According to recent research, 70% of tier-one Indian car consumers are willing to consider an electric car for their next vehicle, surpassing the global average of 52% [1]. This milestone raises crucial questions about whether India is at a tipping point in its electric vehicle revolution. EVs have become more accessible, with incumbent manufacturers announcing electrification targets and newcomers launching models tailored for Indian urban environments. The total cost of ownership for EVs is ever closer to achieving parity with ICE vehicles, removing a historical obstacle for EV purchasers. Drawing parallels with Japan’s historical success in the internal combustion engine (ICE) era, India’s strategic investments in EV infrastructure, development, manufacturing, and government initiatives position it for substantial growth. This blog takes a look back at the EV market of 2023.

India’s EV Landscape: Promising Regulatory Environment

Governments worldwide are actively shaping the EV landscape through regulations and investments. In the US, legislative actions aim for 50% EV and hybrid sales by 2030. In China, tax breaks, R&D subsidies, and government investments in EV companies have fueled the industry’s growth. India has been making significant strides in creating a conducive regulatory environment for EVs, with initiatives like the National Electric Mobility Mission Plan 2020 (NEMMP) and the Faster Adoption and Manufacturing of Electric Vehicles in India (FAME) series, which offer subsidies and a strategic roadmap to accelerate the country’s shift to electric mobility. At the state level, incentives such as electricity tariff subsidies, road tax and stamp duty waivers, SGST refunds, and direct per kilowatt-hour incentives have been introduced to support EV adoption. Moreover, proactive measures are in place to bolster EV manufacturing and charging infrastructure, including providing land, capital subsidies, and support for ancillaries and original equipment manufacturers (OEMs) to create an integrated EV ecosystem.

The expansion of EV charging infrastructure has also seen rapid growth, receiving a boost in April 2018 when policy support led to the deregulation of licensing requirements for charging setups. As of July 31, there were 9,113 public charging stations equipped with 15,493 chargers across the country, and an ambitious plan is set to expand this number by an additional 22,000 charging stations by December 2024 [2]. This expansion is a testament to India’s dedication to establishing a robust framework for the future of electric mobility.

Understanding the Indian

Sustainability is a top priority for Indian consumers, influencing their desire for EVs. 75% of Indians are changing their behaviour based on sustainability considerations, with a preference for sustainable brands. Most consumers prefer full-battery electric vehicles (49%) over plug-in hybrid electric vehicles (21%) for their next car purchase. Factors driving this preference include environmental impact, lower total cost of ownership, and reduced engine noise[1].

However, there are still some challenges and concerns regarding EV adoption. Concerns exist regarding charging infrastructure readiness, with over 75% feeling that India lacks well-set-up charge points. Convenient charging points and long-term test drives are identified as factors that can accelerate EV adoption. While 58% of consumers show an affinity for public charging, 42% prefer home charging, which is considered cheaper, more convenient, and accessible. Limited home charging access is not considered a significant hindrance to EV adoption, with two-thirds of consumers willing to buy EVs even without home charging. Additionally, the test drive experience is crucial, with 24% of sceptics indicating it as an important tipping point in the purchase journey. Long-term test rides with at-home services can alleviate customer anxiety about adopting new products and technology[1].

The transition to EVs is transforming the car-buying landscape in India. Over 70% of consumers initiate their car purchase journey online, with about 40% willing to make online purchases. However, a physical touchpoint with an OEM or dealer is still required for services like test drives, negotiations, and questions. While outright purchase remains popular (79%), flexible ownership options like leasing, subscriptions, or pay-per-use models are gaining traction[1].

EVs could become a significant revenue contributor for manufacturers as consumer demand accelerates. Car dealers may need to adapt their sales and service offerings to meet the growing demand for electric cars. Grid operators may experience increased electricity demand, necessitating existing infrastructure upgrades. Cities play a crucial role in shaping the EV transition, providing infrastructural conditions for charging needs and implementing effective policy measures. The shift to electric cars in India extends beyond OEMs, contributing to progress toward a more sustainable India.

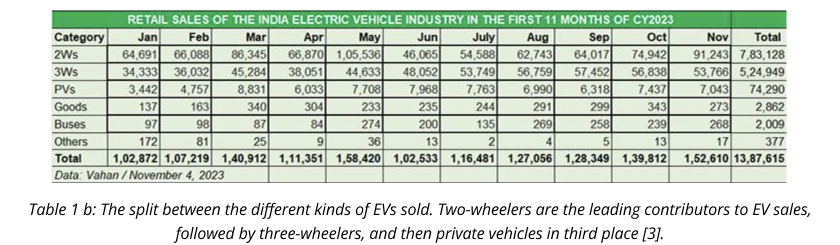

India’s Impressive EV Sales Growth

India’s EV sales have witnessed a remarkable uptick, reaching 1.3 million units in the initial eleven months of CY2023, representing a 50% increase over the previous annum. Most electric vehicles purchased are two- and three-wheelers used for shared and smaller mobility. Two-wheelers have a share of 56%, and three-wheelers have a share of 38% in the Indian EV pie. Let’s take a closer look at the individual categories:

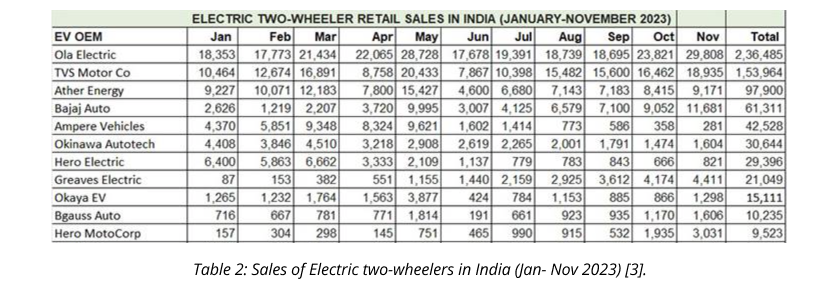

A) Two Wheelers:

In India’s electric two-wheeler sector, Ola Electric has secured a dominant 30% market share, while TVS has made significant sales of over 150,000 iQubes. Ather Energy and Bajaj are engaged in a close contest. Ola Electric’s growth is attributed to the popularity of its S1 series, which had record sales in the first 11 months of 2023. TVS’s iQube also saw its second-highest monthly sales in November. Ather Energy, holding a 12.50% market share, faces stiff competition from Bajaj Auto, which has been increasing sales with its Chetak model, boasting a 7.82% market share and a surge to 13% in November alone.

At the fifth spot is Ampere Vehicles, a Greaves Cotton subsidiary, with strong sales for its new Ampere Primus e-scooter, while the combined sales of Ampere Vehicles and Greaves Electric surpass Bajaj Auto. Okinawa Autotech and Hero Electric also show significant sales figures, although they have experienced a slowdown. Newer entrants like Okaya EV and Bgauss Auto are making their mark, and Hero MotoCorp, another established player, has recorded its best-ever monthly sales in November.

The electric two-wheeler market in India is witnessing robust competition, with traditional automotive giants and new startups vying for market share in an increasingly EV-friendly consumer environment.

B) Three Wheelers:

In India’s electric three-wheeler market, Mahindra Last Mile Mobility leads with a 9% share, while YC Electric, Saera Auto, and Piaggio are significant contenders, and Bajaj Auto is a notable new entrant. The e-three-wheeler segment, including passenger and cargo vehicles, is experiencing robust growth due to the high demand for passenger transport and last-mile delivery services. Mahindra Last Mile Mobility, with over 49,000 units sold and a 9.43% market share for January-November, continues to expand, offering six EV models, including the Treo series for passengers and cargo.

YC Electric Vehicles holds the second position with a 7% market share, selling 36,836 units. Its affordable pricing is driving its popularity. Saera Electric Auto, in third place, commands a 5% market share with 26,675 units sold.

Piaggio Vehicles is also gaining market traction, with a 3.56% share from 18,721 units sold, bolstered by new models and network expansion. Significant players like Mini Metro, Champion Polyplast, Unique International, Hotage Corporation, and JS Auto surpassed 10,000 sales.

The top 10 OEMs with significant five-figure sales collectively hold a 41% market share. In contrast, the remaining 59% is split among 465 other manufacturers, indicating fierce competition.

Despite only entering the market six months ago, Bajaj Auto has sold 3,314 units, indicating a strong growth trajectory and the potential to climb the ranks in this crowded field rapidly.

C) Private Vehicles:

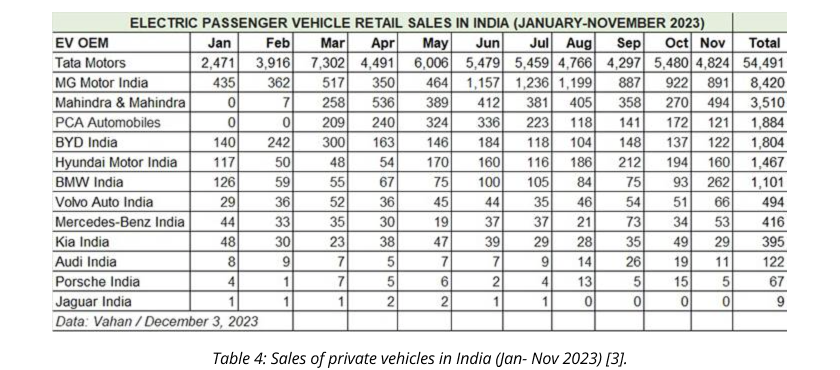

In the burgeoning Indian electric vehicle (EV) market, Tata Motors dominates with a 73% market share in the electric cars and SUVs segment, while MG India holds a 10% share, and Citroen India has edged out BYD India.

Despite their higher upfront cost than petrol or diesel vehicles, the growing preference for EVs is evident on Indian roads with an increasing presence of green-plated vehicles. The first 11 months of 2023 saw a substantial 145% year-over-year increase in electric passenger vehicle sales, surpassing the total sales of 2022 by over 36,000 units.

With its varied EV lineup, including Nexon EV, Tigor EV, Tiago EV, and Xpres-T, Tata Motors sold around 54,491 units, capturing approximately 73% of the market. Although Tata’s share has slightly declined from above 80% due to a more dynamic market with new entrants, it remains the clear market leader. MG Motor India, offering the ZS EV and Comet EV, is the second leading EV manufacturer with an 11% market share based on 8,420 units sold.

Mahindra & Mahindra is in third place with a 4.72% market share, selling 3,510 units of its electric lineup, including the XUV400 and eVerito. Though a newcomer to the EV market, Citroen India has surpassed BYD India with a 2.53% market share, selling 1,884 units of its eC3 hatchback since its launch. BYD India follows closely with a 2.42% market share from its Atto 3 SUV and e6 MPV sales.

Hyundai Motor India and Kia India have collectively sold 1,862 units, with Hyundai’s Kona and Ioniq 5 models and Kia’s EV6. In the luxury segment, representing 3% of the total ePV sales, BMW India leads with 1,101 units, ahead of Volvo Auto India, Mercedes-Benz, Audi, Porsche, and Jaguar. This data indicates a robust and diverse EV market in India, with a clear trend towards increased adoption and a wider range of available models.

D) Commercial Vehicles:

In India’s electric commercial vehicle (e-CV) sector, Tata Motors maintains its leadership position, with Mahindra securing second place and PMI Electro Mobility coming in third. Electric commercial vehicles, which include goods carriers and buses, are proving to be economically advantageous due to their lower total cost of ownership (TCO) and the higher mileage they cover compared to personal EVs.

Tata Motors, with a sale of 2,434 units, commands a 50% share of the market. Mahindra Last Mile Mobility’s 304 units give it a 6.24% market share, closely followed by PMI Electro Mobility with 281 units and a 5.76% share. Other notable players like Olectra Greentech, BYD India, Mytrah Mobility, Switch Mobility, JBM Auto, and Piaggio Vehicles also recorded sales in the triple digits during the first 11 months of 2023. The e-CV sector is poised for further growth, especially for electric buses, due to the government’s recent allocation of Rs 57,613 crore to procure 10,000 electric buses, signifying strong governmental support for the industry.

Is India at Its Tipping Point?

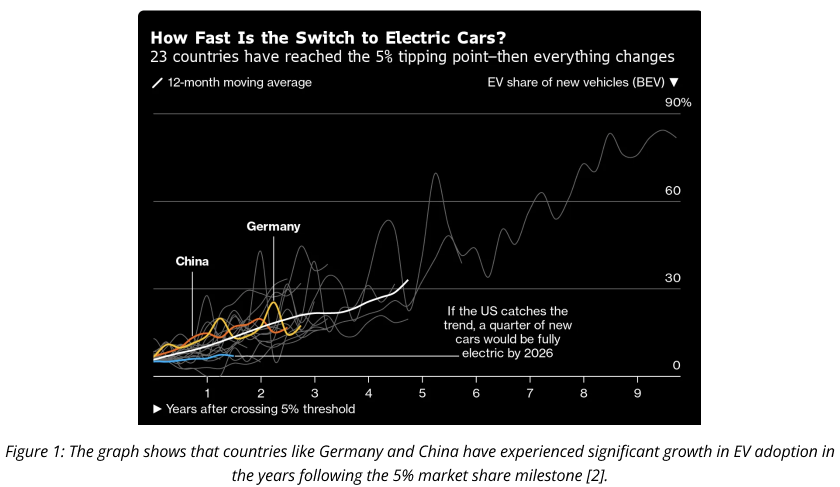

The global electric vehicle adoption is characterised by the strategic inflexion point of reaching 5% of new vehicle sales. A tipping point is a point where the price becomes a decisive factor in the adoption of a particular technology, i.e., it becomes cost-competitive. This tipping point historically marks a shift from early adopters to mass mainstream consumer acceptance, leading to a significant increase in electric vehicle sales. Global projections indicate a decline in gas-powered vehicle sales, reinforcing the momentum towards electric vehicles. Hence, is India’s current electric vehicle (EV) market at a tipping point? Will the sales of EVs increase significantly in India? As of December 26th at 8 am, according to the latest figures on the Vahan government website, EVs constitute 6.32% of the vehicles sold in 2023— proving that EVs in India are slowly inching past the tipping point and on the way to mass adoption!

The country’s trajectory in the EV landscape is bolstered by concerted efforts from the government, industry stakeholders, and a consumer base that is gradually embracing electric mobility. Government-backed initiatives, such as ambitious targets for a significant EV fleet by 2030 and substantial investments in infrastructure, are key drivers of this progress. Although challenges remain, India’s dedication to enhancing its EV infrastructure, reducing costs through innovation, and implementing sustainable practices showcases its commitment to becoming a major force in the global EV arena. The confluence of these factors places India on the cusp of an electric revolution, with the potential to significantly accelerate the adoption of EVs in the coming years.

References:

- https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/consumers-are-driving-the-transition-to-electric-cars-in-india

- https://www.wrightresearch.in/blog/indian-electric-vehicle-sector-booming-evs-tipping-point/

- https://www.autocarpro.in/analysis-sales/ev-sales-in-india-jump-50-to-138-million-units-in-january-november-2023-118053

Latest Blog Posts

Battery Modeling and the Goldilocks Zone

Battery Modeling and the Goldilocks Zone Get Started Contact Us...

Read MoreIndia’s Electric Vehicle Market: A Look Back at 2023

India’s Electric Vehicle Market: A Look Back at 2023 Get...

Read MoreHybrid Modeling: Bridging Physics and Machine Learning

Hybrid Modeling: Bridging Physics and Machine Learning Get Started Contact...

Read More